Contents:

If you are going to offer your customers credit or if you are going to request credit from your suppliers, then you have to use an accrual accounting system. Credit SaleCredit Sales is a transaction type in which the customers/buyers are allowed to pay up for the bought item later on instead of paying at the exact time of purchase. It gives them the required time to collect money & make the payment. DebitDebit represents either an increase in a company’s expenses or a decline in its revenue. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements.

- The editorial asserted that not enough new bookkeepers are emerging to replace professionals aging into retirement.

- If you enjoy organization and numbers and have experience with bookkeeping, starting your own business offering this service might be a smart career choice.

- However, you don’t have the safety net of a regular paycheck and potential benefits such as health insurance and retirement.

- In comparison, bookkeeping is limited to recording and organizing financial information.

- In terms of cities, the leading destinations for bookkeepers also rank among the largest metro areas in the United States.

While they seem similar at first glance, average collection period formula and accounting are two very different mediums. Bookkeeping serves as more of a preliminary function through the straightforward recording and organizing of financial information. Accounting takes that information and expands on it through analyzing and interpreting the data. QuickBooks Live bookkeeper can help ensure that your business’s books close every month, and you’re primed for tax season. Our expert CPAs and QuickBooks ProAdvisors average 15 years of experience working with small businesses across various industries.

Income Statement Accounts

Accounting is the interpretation and presentation of that financial data, including aspects such as tax returns, auditing and analyzing performance. A small business can likely do all its own bookkeeping using accounting software. Many of the operations are automated in the software, making it easy to get accurate debits and credits entered.

There are dozens and dozens of bookkeeping options available and the choices may seem overwhelming. We’ve analyzed and rated the best online bookkeeping services to help you make the best decision when choosing the right one. In this day and age, the providers you contract with don’t need to be in the same city, state or even time zone as you. Remote work has expanded across nearly every field, including bookkeeping. If you find someone who is a good fit for your business needs, it doesn’t matter if they are in California while you work from New York. You’ll want to create a contract that outlines details, such as deadlines, rates and expectations so that everyone is on the same page.

Ways to Save on Expenses and Increase Profits

In terms of pay, bookkeepers tend to earn the most by working in niche industries. Compared to other major employment sectors for bookkeepers, they host relatively few jobs. As such, candidates should expect a more competitive landscape if applying for available openings.

Both Primary and Secondary data sources are being used while compiling the report. North America, especially The United States, will still play an important role which cannot be ignored. Any changes from United States might affect the development trend of Bookkeeping Service Provider Services. The market in North America is expected to grow considerably during the forecast period.

How To Make an Extra $1000 a Month – The Everygirl

How To Make an Extra $1000 a Month.

Posted: Tue, 18 Apr 2023 05:01:24 GMT [source]

Accurate classification of transactions enables you to produce financial management reports which can be used to make strategic business decisions. If you find that you have a talent for and enjoy the process, you may consider starting your own bookkeeping business providing this service to others. There’s always a demand for experienced, efficient bookkeepers in nearly every industry. Companies often outsource the organization of their finances to independent professionals, then hire accountants for more complex issues and tax filing.

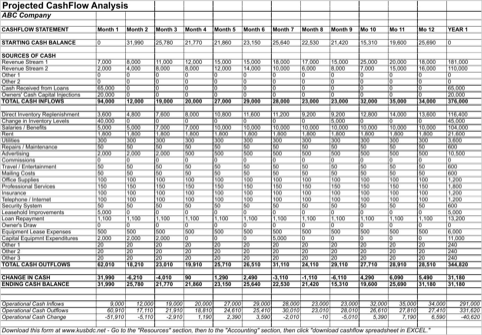

One way to stay organized and keep track of finances is to use accounting software. This software helps bookkeepers enter income and expenses, as well as create financial statements. Additionally, many bookkeeping businesses use online tools and resources to stay organized and efficient. Since the information gathered in bookkeeping is used by accountants and business owners, it is the basis of all the financial statements generated. Most accounting software allows you to automatically run common financial statements such as an income and expense statement, balance sheet and cash flow statement.

Understand the total compensation opportunity for a Bookkeeper, base salary plus other pay elements

General LedgerA general ledger is an accounting record that compiles every financial transaction of a firm to provide accurate entries for financial statements. The double-entry bookkeeping requires the balance sheet to ensure that the sum of its debit side is equal to the credit side total. A general ledger helps to achieve this goal by compiling journal entries and allowing accounting calculations. Once you’ve figured out your ideal accounting method, start by creating a balance sheet, which you will use to record and track equity, liabilities, and assets. This step will allow you to do a cost-benefit analysis of your product or service to determine if the way you’re conducting business is resulting in profit or loss. In addition, consider the tax implications and other business-related expenses to be deducted from earnings.

To be considered, you will need a degree in accounting and at least five years of work experience. If you’re looking for a full-time, work-from-home job with benefits, check out AccountingDepartment.com. The company has an all-virtual staff and offers bookkeeping, controller and advisory services. Liabilities include credit card balances, amounts due to vendors , loan balances and tax liabilities that have not yet been paid. Operating expenses are the expenses incurred in earning operating revenues. For example, advertising expense is one of the operating expenses of a retailer.

– Use Accounting Software

Credentials like the CB and CPB certifications may also help bookkeepers develop the superior skills that boost their overall compensation rates. Industry observers agree that software improvements have made bookkeeping more efficient. As a result, the profession’s growth rates have slowed, but the Strategic Finance article notes growing gaps between the number of open jobs and the number of people qualified to fill them. The chart of accounts may change over time as the business grows and changes.

Clarence Thomas plans to amend financial statements after reports, source says – WWSB

Clarence Thomas plans to amend financial statements after reports, source says.

Posted: Tue, 18 Apr 2023 14:01:00 GMT [source]

With insights from all three of these reports, you can make informed decisions about how best to grow your business. Using information on the income statement, companies can use earnings per share to measure profitability. Earnings per share can be calculated by dividing the company’s profits by shares of common stock. Analyzing the income statement can provide insights into the profitability of a company, as well as the potential for future growth.

What is a Bookkeeper?

Income statement reports show financial performance based on revenues, expenses, and net income. By regularly analyzing your income statements, you can find areas of improvement, compare your business against competitors, and gather other key financial insights. Theincome statement is developed by using revenue from sales and other sources, expenses, and costs. In bookkeeping, you have to record each financial transaction in the accounting journal that falls into one of these three categories. Accounting PeriodsAccounting Period refers to the period in which all financial transactions are recorded and financial statements are prepared.

- Even sole proprietary businesses and small firms such as local stores and dealers require bookkeeping for tracing expenses, revenue, sales, and purchases.

- Starting a bookkeeping business can be a great way to earn an income and build wealth over time.

- It is not uncommon for an experienced bookkeeper to make a career transition into accounting or another profession.

- Information provided on Forbes Advisor is for educational purposes only.

- Debits and credits should always equal each other so that the books are in balance.

- There’s always a demand for experienced, efficient bookkeepers in nearly every industry.

Effective bookkeeping requires an understanding of the firm’s basic accounts. These accounts and their sub-accounts make up the company’s chart of accounts. Assets, liabilities, and equity make up the accounts that compose the company’s balance sheet. Bookkeeping is the process of keeping track of every financial transaction made by a business firm from the opening of the firm to the closing of the firm. Depending on the type of accounting system used by the business, each financial transaction is recorded based on supporting documentation.

Amex Customers – Above-Average-Income Consumers – Are … – WOLF STREET

Amex Customers – Above-Average-Income Consumers – Are ….

Posted: Fri, 21 Apr 2023 18:06:35 GMT [source]

Bookkeeping attracts career-minded professionals with its low barriers to entry and strong upward mobility. The chart of accounts lists every account the business needs and should have. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

For business owners who don’t mind doing the data entry, accounting software helps to simplify the process. You no longer need to worry about entering the double-entry data into two accounts. Liabilities are what the company owes like what they owe to their suppliers, bank and business loans, mortgages, and any other debt on the books. The liability accounts on a balance sheet include both current and long-term liabilities. Accounts payable are usually what the business owes to its suppliers, credit cards, and bank loans.